The German federal government has set itself the task of creating affordable living space. This has become a priority since forecasts have indicated that, by 2030, Germany will need 320,000 new flats – per year. However, construction has so far been insufficient, too slow and too expensive. From a financing perspective, banks can provide momentum for the ongoing discussion.

Under what conditions do banks finance living space?

For banks to provide financing, it is vital that the construction projects are economically viable. The creditworthiness and debt servicing capacity of the consumer or borrowing company are fundamental requirements. Businesses must be able to prove they have a healthy level of debt and collateral. The planned construction project must be economically viable and the financed investment must promise reasonable returns. This is because every euro financed must be repaid to the bank during the contractually agreed term. In Germany, this works well: The market for construction financing is stable and functional, and shows a high degree of competition, transparency and choice.

Why is construction financing important for banks?

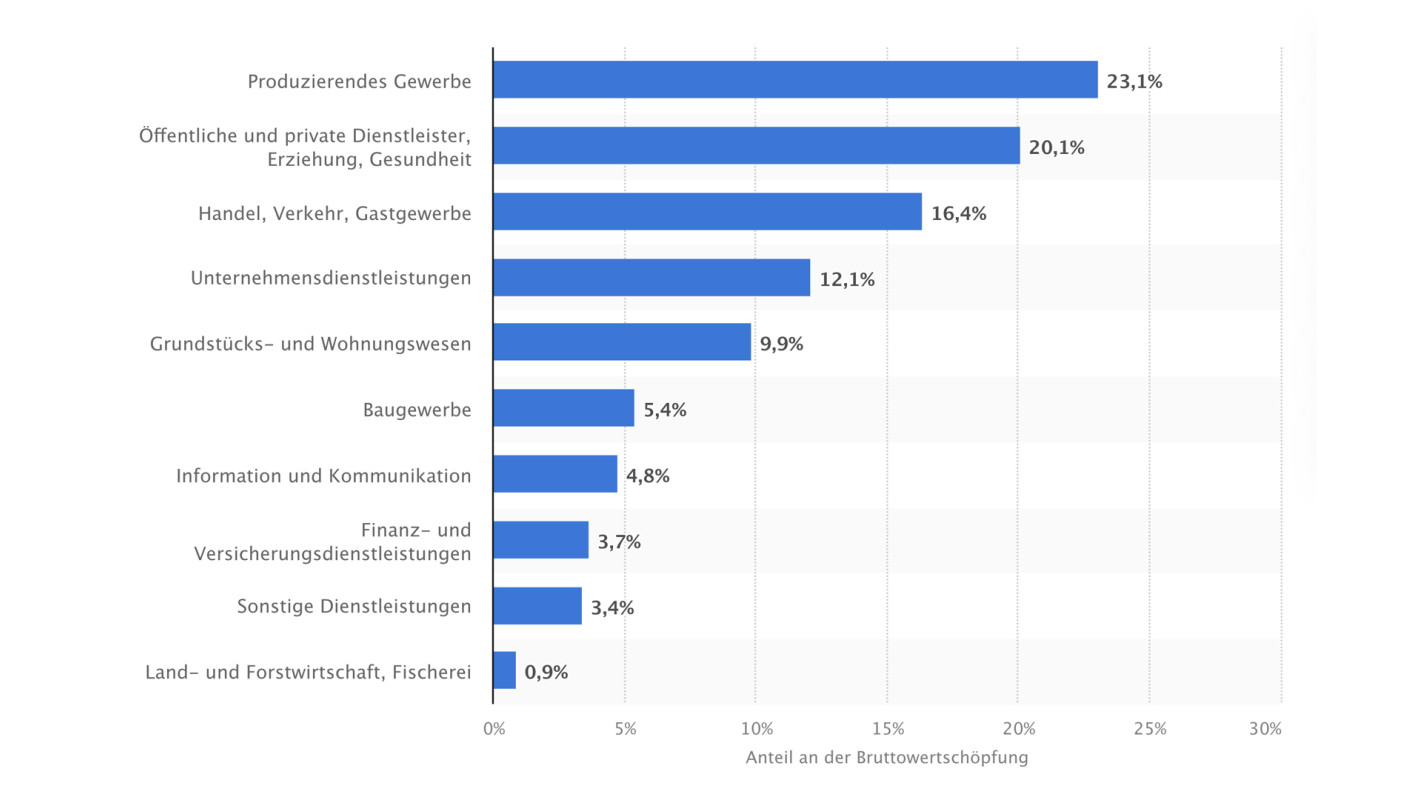

For banks, the focus on construction financing is not only about creating private living space, but also because the construction industry is an important economic sector in Germany. Its share of gross value added is 5.4 percent. Together with the real estate and housing sector, which comprises the development, rental, brokerage and management of real estate, the share of gross value added related to buildings is around 15.3 per cent. Planners, tradespeople, building material manufacturers, insurers and energy service providers also benefit from the value chain. Unlike in sectors whose services and products have consistent demand, such as healthcare or the food industry, the construction sector is strongly influenced by classic, cyclical fluctuations. Variations of 1 to 1.5 percent in the share of gross value added attributable to the construction industry alone are common, depending on the development of the economy, interest rates and construction costs. And this is also reflected in the demand for credit, both negatively and positively.

Who do banks provide financing for in the construction industry?

In Germany, banks grant classic real estate loans to private customers, provide the residential and construction industries with investment loans and capital market products and finance project developers and the tradespeople doing the construction work. The following section focuses on commercial residential construction. Local government and private residential construction companies are important in identifying regional demand and making large amounts of living space available.

Why is there insufficient housing construction? What are the possible solutions?

Despite a functioning financing environment, not enough housing is being built in Germany. According to the Senate, Berlin alone will have a shortage of up to 140,000 apartments by 2030. There are reasons for this. And there are ideas for solutions.

Construction costs

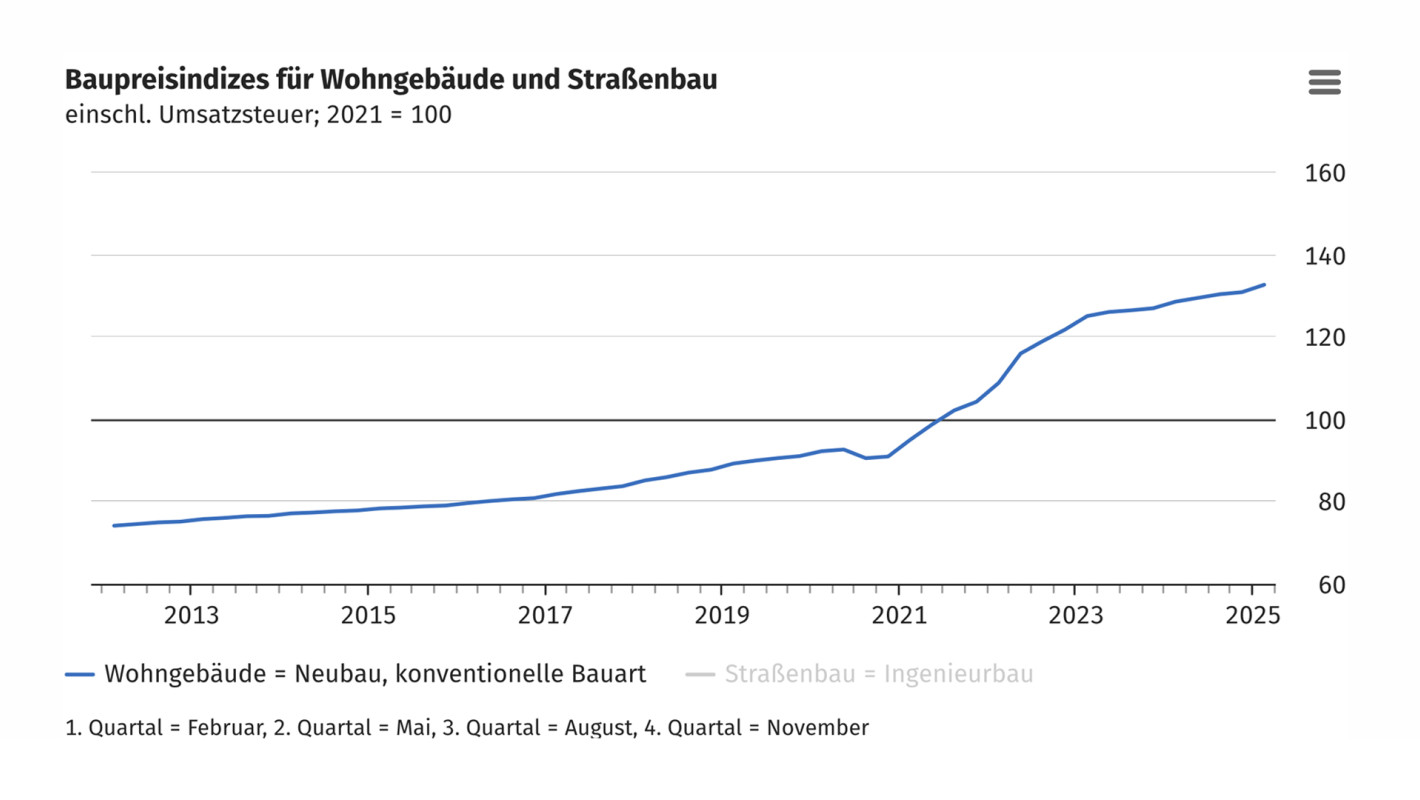

Between 2020 and 2024, construction costs rose by around 40 percent. In addition to sharp increases in material, labour and energy costs, costs associated with regulatory requirements (e.g. fire protection, sound insulation, energy consumption) have also risen significantly. At the same time, local government debt is rising, which reduces the ability of local authorities to provide their housing associations with sufficient capital funding. The development of new building land is also a bottleneck factor and cost driver for many local authorities. Constantly increasing construction costs require higher and higher target rents of €20 per square metre on average (net rent excluding utilities) to cover the total costs of a new construction project.

The costs of new construction projects must be reduced if affordable living space is be created.

Approval process

Standard processing periods until a construction project can begin are often very long.

However, the complete digitalisation of the approval process has a great deal of potential to speed things up. The ‘digital building permit’ has been issued in some federal states since 2021 and is a step in the right direction. The German government’s ‘construction turbo’ initiative, a special provision in the Building Code up to 2030 that aims to shorten approval procedures at the local government level, could also provide some impetus.

Construction standards

Building regulations and energy standards can drive up costs. And the situation is further complicated by significant differences in state building regulations. This often represents an additional cost factor for construction companies that operate across the whole of Germany.

An ‘experimental clause’, as proposed by the German Economic Institute, might be a pragmatic approach to overcoming this issue. The idea behind it: Deviating from strict construction regulations is permitted if it can be demonstrated that the intended objective can also be achieved with more flexible standards. There should also be a ramping up of highly anticipated serial construction projects. Both can reduce construction costs.

Legal planning security

Germany is on its way to becoming net zero. Now there needs to be continuity, for example, in terms of heating supply to buildings and local authority areas.

A reliable building energy law and rapid progress on municipal heat planning are requirements for the planning security of investments.

Funding

Reliable, market-based support for new construction projects could boost private and commercial investment.

The funding should be based on the KfW concept proposed in the coalition agreement. Small-scale specialised programmes with a small target group and little market relevance must be replaced by standard programmes in a basic version with additional options. This should also make the advice provided by banks on KfW programmes and application processes more efficient, thereby increasing market acceptance.

Regulation and lending

Until now, a sectoral systemic risk buffer of two percent has applied to residential real estate financing. The buffer increases capital requirements for banks and is intended to have a restrictive effect on lending in order to prevent housing bubbles. However, a predicted systemic overheating of the property market has not materialised. Consequently, this year’s reduction of the systemic risk buffer to one percent is a positive first step.

Reducing the buffer to zero percent over the course of the year would be the next logical and appropriate step.

Economic trends

Over the past three years, the economy has been stagnant and there has been little willingness to invest. This has had an impact on construction activities. Low demand for financing is often reflected in weak lending growth across all sectors and industries – despite the availability of capital.

A growth spurt for the economy overall would also be crucial for new investment in buildings. The federal government has provided an important stimulus with its special fund and investment booster.

Interest rate

The phase of exceptionally low interest rates after the financial crisis until around 2022 were followed by a massive increase in construction interest rates up to 5 percent, which further dampened construction activity. Construction interest rates have now stabilised at a normal level.

The overall interest rate depends on the monetary policy decisions of the European Central Bank, which acts independently. Nevertheless, in historical terms, construction interest rates are currently rather moderate.

Finanzierung bezahlbaren Wohnraums

Contact

Ruth von Oppen

Corporate Finance